While solid figures and record inflation in the US and UK are forcing central banks to apply the brakes, measures to counter the gas crisis and ongoing uncertainty are likely to stifle GDP growth in the eurozone, according to Swiss Life AM. In China, the state of the real estate sector is worse than expected. Infrastructure projects to drive growth.

In contrast to neighboring Europe, the Swiss economy was still in robust shape until mid-year. The domestic economy remains supported by high employment and catch-up effects in the services sector. Foreign trade also proved strong over the second quarter. After a setback immediately following the Russian attack on Ukraine, the State Secretariat for Economic Affairs (SECO) weekly economic activity indicator WWA climbed throughout the second quarter. Swiss Life Asset Managers continues to expect real gross domestic product to grow by 0.6%.

"While the growth forecast for the current year does not deviate from the consensus forecast, we remain significantly more cautious about the economic trend in 2023. This is despite the fact that the consensus forecast has experienced a slight downward revision for two consecutive months," say Swiss Life AM economists. In their assessment, the list of causes for the impending slowdown is long:

- Higher financing costs are affecting construction activity and accelerating the trend toward rising corporate bankruptcies.

- The growing threat of recession in Germany and the USA will be felt in the form of lower foreign demand.

- As elsewhere, the risk of an electricity shortage weighs on the outlook for the coming months.

- As the experts further explain, the strong franc is already having a dampening effect via a lower risk of imported inflation. In June, the annual rate of change in the producer and import price index remained at 6.9%. A quarter of the national consumer price index is made up of import prices, which also include energy products. So the effect of lower import prices on inflation could be significant. However, price increases in the service sector, some of them substantial, are still to be observed.

Forecast comparison

USA: Waiting for recession

On the one hand, inflation is stubbornly persisting in the USA. It increased in June from 8.6% to 9.1% increase, driven by higher energy prices. Core inflation fell less than expected (from 6.0% to 5.9%) and continues to show a broadening of inflationary pressures. According to Swiss Life AM, significant price increases for rents were conspicuous in June (7.2% weight in the basket of goods) and in owner-occupied rental value (23.5% weight).

On the other hand, economists and financial markets are largely in agreement: the recession in the USA is coming. The debate is mainly about when it will happen and how hard it will be. Swiss Life AM economists would reject the idea that the US is already in a recession. The figures from the labor market and industry were still too robust, and private consumption even increased slightly in real terms in the first half of the year. Where they already see recessionary trends is in the US housing market.

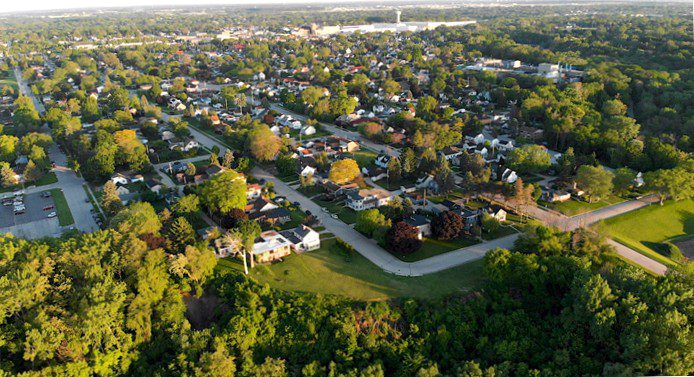

The turnaround in interest rates has quickly translated into higher mortgage rates, and transactions of existing properties plunged 16% in the first half of the year. It is interesting to note that the positive trend in house prices is unbroken, as shown by the highly regarded Case-Shiller House Price Index (+8% in the first half of the year) and also by the Owner's Equivalent Rent in the Consumer Price Index (+3% in the first half of the year).

Owner-occupied rental value is surveyed and has recently gained momentum, arguing against an immediate recession – this component tends to be very sensitive to recession fears. Swiss Life AM still considers a mild recession next year to be the most likely scenario.

China: New growth drivers sought

China's economy grew much slower than expected in the second quarter, prompting Swiss Life AM to lower its 2022 GDP forecast from previously 4.3% to 3.5% lower. The real estate sector in particular has been a negative surprise. Both real estate investment and residential construction activity were down sharply. Meanwhile, sluggish construction activity has also been the trigger for a wave of mortgage payment denials as more and more pre-sold housing projects are not completed. So far, the extent of the mortgage boycott makes only about 0.01% of total mortgages in the Chinese banking sector out. Nevertheless, an increasing number of unfinished housing projects would exacerbate the crisis of confidence and lead to even lower sales.

Therefore, the government intervenes and urges banks to increase lending for unfinished projects. In addition, it appears that consideration is being given to allowing real estate buyers to default on their mortgages on the affected uncompleted projects in the meantime. However, these measures only served to slow down the downward trend of the sector, not to boost its growth, as Swiss Life AM further explains.

"The days of the real estate sector serving as a growth engine for China's economy are numbered. Instead, the country is looking for alternative growth drivers by encouraging investment in infrastructure and high-end manufacturing," economists conclude.

Inflation in China remains moderate. China's consumer prices rose by 2.5% year-on-year increase. In particular, core inflation has remained low, at 1 in June.0% (May: 0.9%). This reflects subdued consumer demand due to the uncertain covid situation and potential lockdowns.

Eurozone: ECB steps out of the shadows

Once again, Swiss Life AM's inflation forecasts for 2022 and 2023 in the eurozone underwent an upward revision. The same is true for the consensus forecast. Swiss Life AM expects inflation to rise further to 8.9% as of September 2022. If one excludes the risk scenario of a collapse of the energy supply in the coming winter, a declining inflation dynamic is to be expected thereafter. In the baseline scenario, the inflation rate would fall again towards 2% by the end of 2023.

"Ten years after Mario Draghi's promise that the European Central Bank (ECB) would do whatever it takes to ensure the continuation of monetary union, he and solidarity among eurozone member countries are once again taking a key role in the European drama," Swiss Life AM notes.

The ECB had yielded to market pressure by announcing a 50 basis point rate hike. At the same time, it launched a new instrument to prevent, if necessary, the feared fragmentation of financial markets within the euro area. Despite this concession by the ECB, Mario Draghi had to give up his new role as Italy's prime minister and pave the way for new elections.

According to surveys among investors by Sentix, the risk of Italy leaving the euro is currently rated as higher than at the height of the debt crisis in 2012. But Europe's solidarity is being strained not only in connection with monetary union. Recently, joint efforts are also being called for to quickly become independent of Russian natural gas. The short-term growth outlook and the inflation forecast for the euro zone depend equally on the success of these efforts.

80% fill level can be achieved

Gas storage levels are currently the talk of the town. But be careful with the interpretation, Swiss Life AM warns: the UK has full gas storage facilities, but they are tiny compared to consumption, while Austria's half-empty storage facilities still cover half of the national annual consumption. Across Europe, the euro is well on track to meet the 80% fill level required by the European Commission by 1. November, which according to experts should be enough for this winter even with a Russian gas supply freeze (with accompanying measures).

"However, what is open – and so far hardly discussed – in this worst-case scenario is how the reservoirs can be filled again for the winter of 2023/24," Swiss Life AM points out.