PROGRAM TEMPORARILY SUSPENDED. Idaho Housing temporarily suspends Mortgage Credit Certificate (MCC) program. Due to the popularity of the program, we have used our tax exemption authority for MCCs. We hope that additional powers will be available in 2023.

A Mortgage Credit Certificate (MCC) issued by Idaho Housing and Finance Association allows a buyer to claim a federal tax credit for 35% of the mortgage interest paid annually, up to $2.000 per year. The customer center is an actual tax credit that can be applied to any federal taxes owed by the borrower. It can be extended for up to 3 years. A buyer may be eligible to receive the tax credit as long as they occupy the home. Borrowers need to contact their tax professionals for specific advice regarding the client center / tax credit.

If you have any further questions about the Mortgage Credit Certificate (MCC), please email [email protected]

What is a mortgage loan certificate?

A Mortgage Credit Certificate (MCC) issued by Idaho Housing and Finance Association allows a homebuyer to receive a tax credit equal to 35% of the mortgage interest paid per year up to an annual maximum of $2.000 to apply. The mortgage interest credit is a non-refundable tax credit, so the homebuyer must be taxable to take advantage of the tax credit. The MCC remains in effect for the life of the mortgage loan as long as the home remains your primary residence.

MCC holders may receive the full mortgage interest credit annually at the time they file their tax return IRS Form 8396. If you have tax questions, we recommend that you consult with a qualified tax advisor.

Do I qualify for a client center?

To qualify for a customer center, borrowers must meet certain criteria, including: Income limits, sales price limits, loan type and first-time buyer status. Your lender can walk you through the requirements and help you determine if you qualify.

How to apply for a customer center?

If you qualify for the MCC program, your lender will provide you with the necessary documents to sign. Certain documents may be signed at application, while others may be signed at closing. There is also a $300 MCC filing fee that is due at closing.

When will I receive a copy of my client center?

Idaho Housing sends on 31. January of the year after you purchase your new home an MCC certificate. This certificate will be used when preparing your taxes. Please keep this document in a safe place. It will be the only one sent to you.

More answers to frequently asked questions.

My loan has already closed and I just heard from the customer center. Can I still apply?

Yes, within 30 days of closing your loan. When filing after closing, the filing fee must be split for $300. $200 goes to your lender and $100 should be sent to Idaho Housing with completed application materials.

How do I get the tax credit once I have my customer center?

You must apply for the credit each year when you file your taxes. Use IRS Form 8396 to claim your credit. If you have questions when completing your taxes, please contact a qualified tax preparer. Idaho Housing cannot provide tax counseling.

If my income goes up, do I then lose the tax credit?

The customer center is valid for the life of the loan as long as the home remains your primary residence. If you sell or move your home and your income is higher, you may be subject to a surrender tax from the IRS. A qualified tax advisor can answer your questions about possible recapture.

What happens if I sell or move the house?

Depending on how long you have been in your home, you may be subject to a redemption tax under certain circumstances. The redemption tax expires after nine years. If you are required to pay a redemption tax due to the customer center administered by Idaho Housing, please contact Idaho Housing as a refund opportunity may exist. Please refer to the application materials for details on potential re-enrollment.

What is the Reimbursement Guarantee?

If you are subject to a redemption tax, there are certain situations where Idaho Housing will refund the amount of the redemption tax. Please contact Idaho Housing for information if you are subject to the tax.

I am thinking about refinancing or am already in the process of doing so. Do I lose the customer center from my original loan?

You can transfer your existing customer center to the new loan. You will need a reissued customer center (RMCC) to transfer the benefit to your new loan. There is an RMCC application that can be signed at or before closing that requires a $50 fee.

please note If you previously refinanced your home and did not apply for RMCC at that time, you will not be able to transfer the benefit to your new loan. A customer center must be reissued each time a home is refinanced or the benefit will be lost.

My refinance has already closed. Can I still apply for an RMCC?

Yes. You can apply for an RMCC 30 days after graduation. Application and $50 fee must be submitted directly to Idaho Housing. RMCC applications after closing are approved on a case-by-case basis. Therefore, it's still best to apply for them before you close on your refinance.

The amount of my refinance loan is higher than my original loan. Can I still receive a reissued customer center credit?

Yes, as long as the amount of credit you claim on your taxes does not exceed the amount claimed with your original loan. We recommend consulting a tax advisor to ensure you are following IRS guidelines for the RMCC when claiming the credit against your taxes.

I am refinancing and my income is above the income limit for the MCC program. Can I still receive a newly issued customer center?

Yes. Income limits are only considered for eligibility at the time you purchase your home. You can still apply for an RMCC when you refinance, even if your income has increased.

I have a question that is not answered here. Where can I find more information?

Your lender or a tax advisor can help answer your questions. For more information on the mortgage interest credit, visit the IRS Here. You can also contact our MCC administrator by email [email protected]

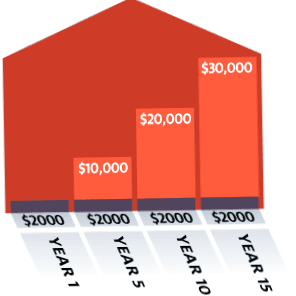

Example of tax credit benefits for borrowers:

(Based on $200.000, 30-year mortgage at 4% interest rate)

| 1 | $7,936 | $2,000 |

| 2 | $7,792 | $2,000 |

| 3 | $7,643 | $2,000 |

| 4 | $7,488 | $2,000 |

| 5 | $7,362 | $2,000 |

| The tax credit applies for the life of the loan; This example shows that in just the first five years, a borrower would receive tax credits of $10.000 could receive. | ||

An example of the savings of a homebuyer who qualifies for the homebuyer tax credit by 15. Year on a 30-year mortgage of $300.000 used at an interest rate of 5%.