Bills not paid on time, too many credit inquiries or ongoing dunning proceedings: These and other factors negatively affect the creditworthiness of prospective borrowers. An unfavorable SCHUFA score can quickly stand in the way of important borrowing for a new purchase or outstanding bills. But there is also a chance to get a loan despite a bad credit rating. Providers such as Vexcash allow the granting of credit in this case, provided that other conditions are correct.

A loan request on VEXCASH has no impact on your personal Schufa score.

Credit despite poor credit rating: Is it possible?

A loan despite poor credit rating is possible, but very difficult. After all, banks protect themselves in advance by checking the creditworthiness of the potential borrower: Creditworthiness indicates how likely it is that the loan will be repaid punctually and regularly, together with interest. Who regularly overdraws his account, has many current loans or pays bills late, negatively affects the credit rating. Then it is quickly over with the (new) granting of credit.

However, typical reasons for rejection of a loan do not only concern the active repayment behavior of the prospective borrower. Loans can also be rejected due to a highly fluctuating or very low income as well as existing unemployment. Conversely, loans can be granted without a credit check by some financial institutions if evidence of a fixed income or existing equity is available.

Possible way out: guarantor or second borrower with poor credit rating

For people with payment difficulties, for example due to unemployment or a low income, on the other hand, it is advisable to specify a guarantor as early as the loan application stage. The latter undertakes in writing to step in if the loan can no longer be paid by the borrower. However, the guarantor must himself meet certain requirements for taking out a loan. This includes, for example, proof of regular income, which the main borrower lacks. The guarantor must also have a good credit rating. For many prospective borrowers, the search for a guarantor is already proving difficult.

The alternative to a guarantee, where the guarantor only has to cover payments in an emergency, is a second borrower. Usually it is the spouse or a close relative of the applicant. In this credit model, installments are paid equally by both parties. However, similar to the guarantor, the second borrower must also convince with a good credit rating or proof of regular earnings.

Improve your own credit rating: This is how it works

Who finds neither a guarantor nor a second borrower and also wants to refrain from SCHUFA-free loans, can improve his own Schufa score. The punctual repayment of these small loans has a positive effect on one's own score, so that subsequently higher loans may also be considered.

Furthermore, it is advisable to obtain the SCHUFA self-assessment, which is free of charge once a year, before taking out a loan. The records in the credit agency are not always up to date or free of errors. A bad credit score may have arisen due to incorrect entries, of which the borrower is completely unaware. In this case, the loan rejection would come as a complete surprise and would put financial planning to a severe test.

Tip: For the future, it should be noted that no specific loan requests, but so-called condition requests are made for interesting loans. Requests for conditions do not require an entry in the SCHUFA and still allow prospective borrowers to choose between different loans.

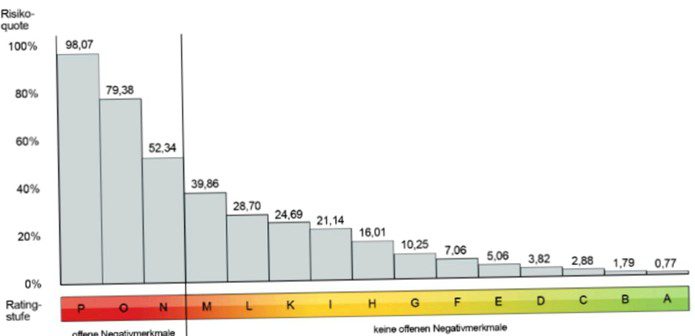

The SCHUFA score for bank customers, as of 2019

For customers of Vexcash is also a lightning loan with the rating level M possible.

| No open negative features | ||

| Rating level | Score | Risk ratio |

| A | 9.863 – 9.999 | 0,80 % |

| B | 9.772 – 9.862 | 1,64 % |

| C | 9.709 – 9.771 | 2,47 % |

| D | 9.623 – 9.708 | 3,10 % |

| E | 9.495 – 9.622 | 4,38 % |

| F | 9.282 – 9.494 | 6,21 % |

| G | 8.774 – 9.281 | 9,50 % |

| H | 8.006 – 8.773 | 16,74 % |

| I | 7.187 – 8.005 | 25,97 % |

| K | 6.391 – 7.186 | 32,56 % |

| L | 4.928 – 6.390 | 41,77 % |

| M | 1 – 4.927 | 60,45 % |

| With open negative features | ||

| N | 4.112 – 9.999 | 48,47 % |

| O | 1.107 – 4.111 | 77,57 % |

| P | 1 – 1.106 | 96,08 % |

Credit despite poor credit rating: Important key data

If the recommended points are all insufficient to obtain the desired loan, interested parties usually look around for a loan without SCHUFA. However, the search could take some time, because such a loan is not offered by all financial institutions. If the SCHUFA-free loan is possible, the other requirements for borrowing are narrowly defined.

Due to the lack of SCHUFA information, the borrower's own evidence of existing assets or income is very important. If the applicant has a certain amount of equity or a regular, fixed income, the loan is often approved despite a negative credit rating. If this is not the case, a guarantor with a good credit rating is often required or the loan amount is sharply limited. Through a purpose, for example, the car loan, an additional security for the bank can also be created, so that the loan is approved without SCHUFA.

Risks for loans without SCHUFA

Borrowers should note, however, that depending on the loan sometimes high fees on him to come. Through this, the bank compensates the higher risk of default of the borrower. A lower loan amount or a shorter term can reduce fees. With a shorter term, however, it must be noted that the rates to be paid can be very high.

Unfortunately, many black sheep also take advantage of the difficult situation of prospective borrowers with poor credit rating. Anyone who wants to apply for a loan despite a bad credit rating should therefore check the seriousness of the provider in advance. Serious banking institutions and other lenders grant the review of the credit request usually free of charge.

Credit despite poor credit rating with Vexcash: This is how it works

As the name suggests, the short-term loan has a shorter term than a conventional installment loan. In addition, low interest rates apply. Furthermore, new assessment standards are applied to the solvency of borrowers. For example, default risks due to insolvency or inability to work are to be classified lower if the small loan is selected at Vexcash. Terms of less than six months are common for this purpose.

Vexcash carries out a risk calculation for possible payment defaults for the aforementioned short-term loans and grants loans of different amounts with different terms based on this calculation. In general, the trust principle applies at Vexcash: New borrowers can apply for a maximum of 1.000 Euro borrow, with punctually paying existing customers, the credit limit increases over time.

Conclusion: Alternative loans for customers with unfavorable credit rating

Through providers such as Vexcash, it is possible to obtain a loan even with a bad credit rating. With a guarantor, second borrower or proof of equity, a negative SCHUFA score can often be compensated for, so that larger purchases or unforeseen financial challenges can be met without any problems.

Is it possible to get a loan with Vexcash despite a bad credit rating??

Yes, due to the short term and low interest rates we have other criteria for the evaluation of our microloan.