Let's face it, creating and managing a budget 10 money management tools in Google Drive you should be using today 10 money management tools in Google Drive you should be using today The problem with money is that if you don't manage it, you end up without it . How about some useful money management tools to help you get started with your Google Drive account? Read more that can be really hard to work with, and that's why so many people don't have one. Fortunately, there is a very simple and easy way to manage your weekly and monthly budgets using Trello.

If you're not familiar with Trello, this is a web app you can use to manage it all. 10 Unique Uses of Trello Other Than Project Management 10 Unique Uses of Trello Other Than Project Management Trello is a list lover's delight. Its Kanban approach wasn't just for project management. Don't take our word for it Check out these ten unique applications from Trello. Read more with lists of "cards."Cards can contain any information, and you can move cards from one list to the next simply by clicking and dragging with your mouse.

How can card lists help you build and manage a better budget? The secret comes from this convenient use "card mix" to manage your cash flow from income to your savings.

Start your Trello budget

Most standard budgets Manage your budget and expenses with Google budgeting tools. Manage your budget and expenses with Google budgeting tools. More information includes starting your income on the top line, listing all expenses and bills below, subtracting and allocating whatever you have left to savings or discretionary spending.

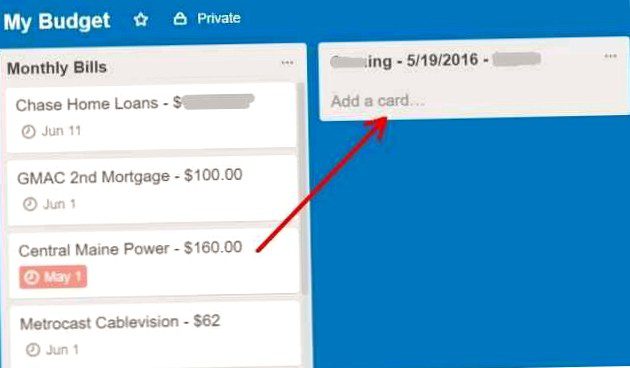

There are many problems with this approach, the main one being that it is very difficult to manage when you receive bi-weekly paychecks and need to track where that income is going. Trello can help, but first you need to create an initial list that includes each of your fixed monthly bills – z. B. Mortgage payments and utilities.

Make sure you include a due date for each so you can quickly see which ones are due soon or in the distant future. Trello also provides a nice red highlight to due dates that have passed or are coming up soon.

Next, create a list for every paycheck you receive. Name these lists with the source of income (probably your employer's name), the date you receive the check, and the amount.

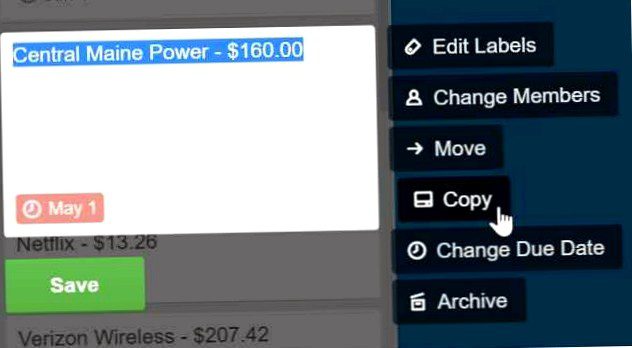

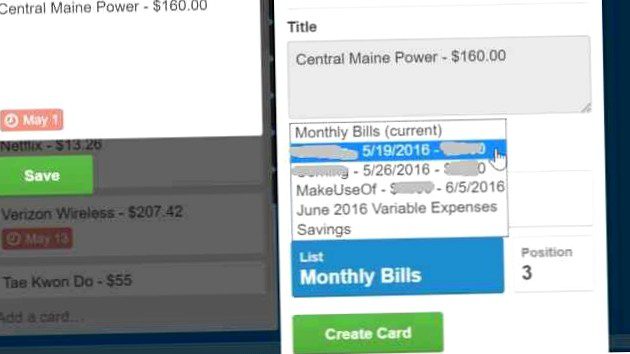

Then go through your expenses that are either past due or soon to be due and copy them.

When you copy the invoice, you have the option to file the copy in another list. Highlight the payroll you just created and select Create Card.

Now you have a list for each of your paychecks for the upcoming month. Using the approach described above, you can assign which check is used for which invoice depending on the due date of those invoices.

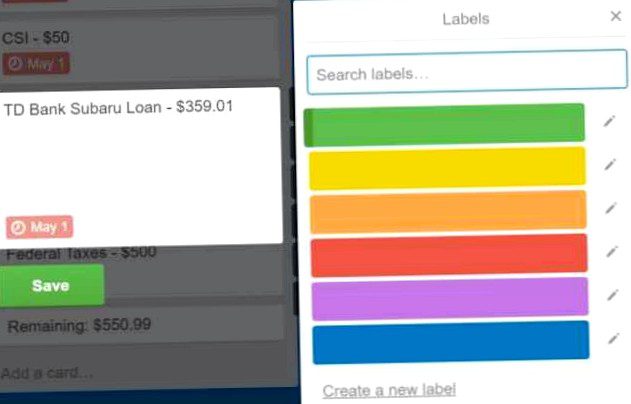

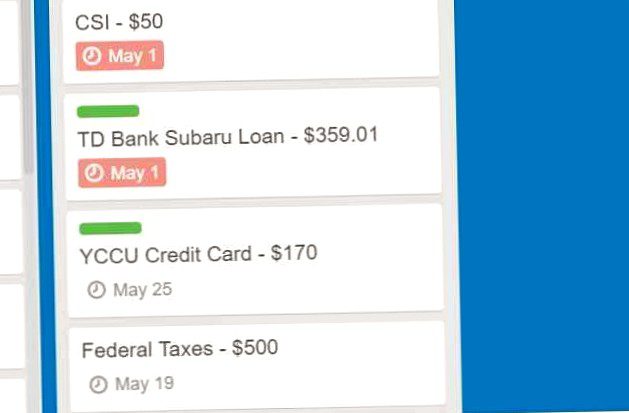

Track paid invoices with labels

One of Trello's more useful features is the ability to tag cards. In budgeting, this is very helpful to keep track of the bills you have already paid this month. When you pay a bill, just click on the card and select from labels.

In my case, I usually designate those that I have paid with green.

If you want, you can flag the bills you can't pay right away, and you'll have to be late with something like yellow or red. That way, when you get your next paycheck, you'll know right away which ones to go after.

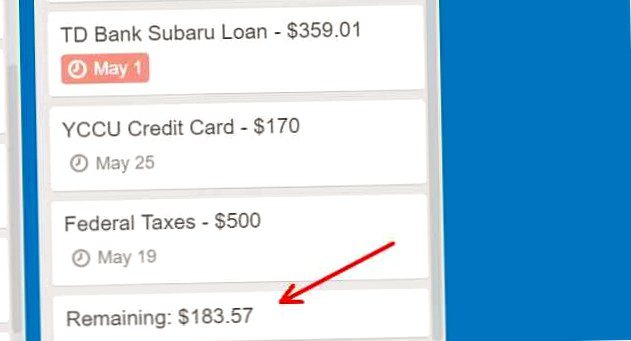

How much is left after bills??

Once you've assigned these individual bills to income schedules, it's time to figure out how much of those paychecks you have left after you've paid those fixed bills. Unfortunately, Trello does not have an automatic calculation feature. Therefore, you need to open the calculator program on your computer and pull it out yourself. Create a map at the end of the list with the remaining amount.

Now you know what to do with the remaining variable bills like groceries, gas, food and other expenses.

On the right side of your income lists, you'll want to make another list of your average variable monthly expenses. If you're having a hard time estimating what these are each month, you can easily figure this out by exporting your last 3 months of bank statements to Excel and spending some time sorting all your expenses into categories.

Sort these by category and add up everything by category for each month. Determine what you normally spent in each category in the last three months and use that number for the budget items in the variable spending list.

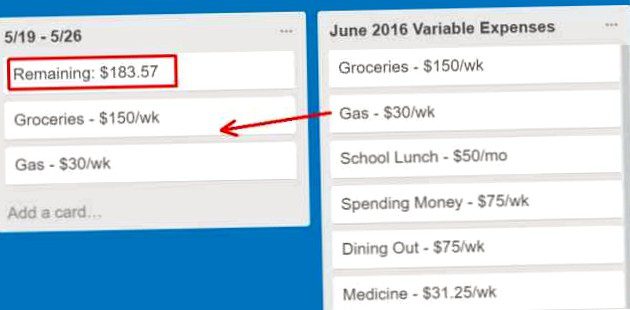

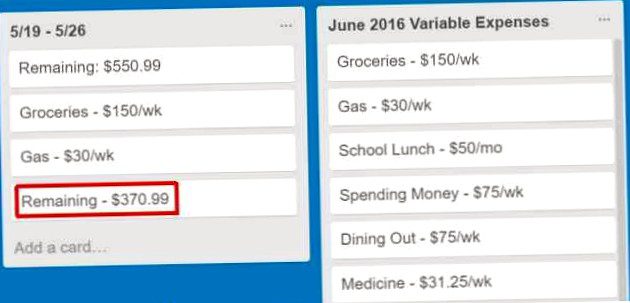

Now, between your variable expense list and your income lists, you should create a list for each two-week period of the month that represents the time between paychecks. The top of this list should be a copy of the "remaining balance" card you just calculated. This is your starting point for making sure you have enough left over after paying the bills to z. B. Groceries to pay.

As you can see from the picture above, it didn't take me long to figure out that I had paid too many set bills and didn't have enough left over for the week's expenses. So I went back to the bill pay list, removed a few large bills (they only need to be paid late), recalculated the remaining amount, and put that new amount back into the bi-weekly list.

Now it's clear that I have enough for groceries and gasoline. Nearly $400 left. If you know you want to dine out during those two weeks, copy the "go out to eat" card to the week's list and subtract. If you know you need to refill your prescription, copy the "medicine" card to the list of the week and subtract.

Organize your savings plan

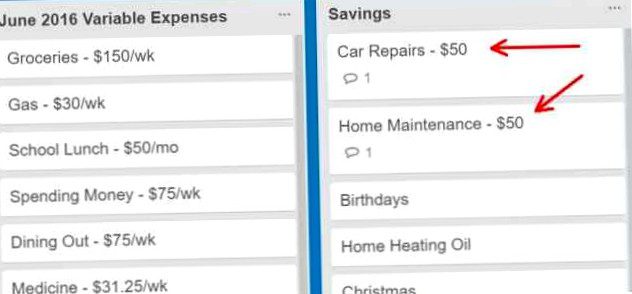

Once you have all your bills and variable expenses available for the two weeks between this paycheck and your next paycheck, you'll know how much money you have left for your savings plans.

The "Savings" List is the last list in your Trello budget. This is a list of things you may want to apply remaining funds to. It may be a vacation, a new car, or an additional retirement plan (possibly a Roth IRA in addition to your existing 401k). Don't forget to save for these things 5 Money-Saving Tips You Need to Know Before Buying a New Laptop Follow these five tips the next time you buy a laptop and you could save hundreds of dollars. Read more you need to be prepared for, z. B. Car repairs or home heating oil.

At this point, you must take the remaining amount after allocating variable expenses for the next few weeks and distribute that amount among as many savings in the savings list as possible.

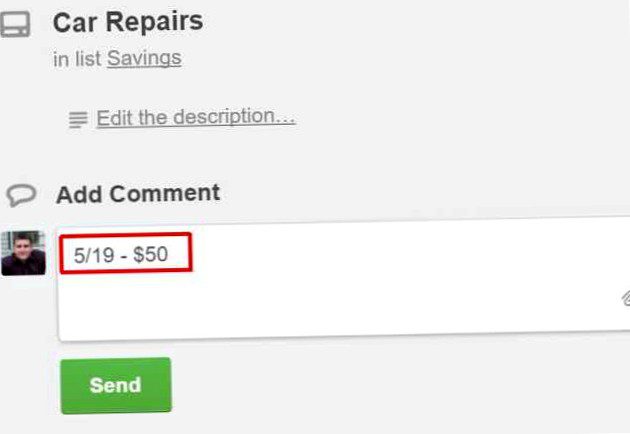

You "allocate" an amount by adding a comment to that card with the date and the amount you added. Then change the title of this card to show the total amount you have saved so far.

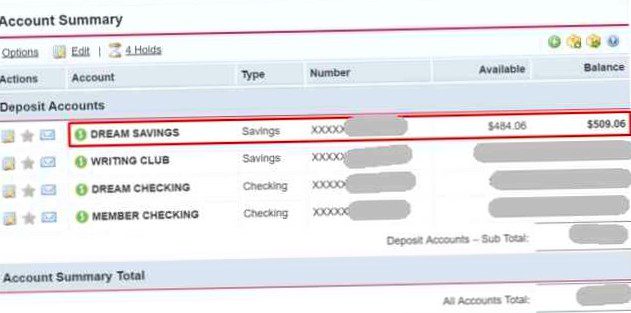

Every time you allocate a portion of your paycheck to "savings" In the list, you should actually go to your bank account and transfer that total amount to your savings account so you don't do this "haphazardly" Spend that money on other things that aren't in your existing budget.

As you can see, using Trello for budgeting is pretty simple. It's a left to right flow of money from one list to the next until the remaining balance ends up in your savings account – as it should be.

The beauty of this system is that it is much more fluid and intuitive than a spreadsheet. 15 Helpful Spreadsheet Templates to Manage Your Finances 15 Helpful Spreadsheet Templates to Manage Your Finances Always keep track of your financial health. These free spreadsheet templates are just the tools you need to manage your money. Read more with a large number. Trello lets you organize invoices, income, variable expenses, and savings in a variety of ways. How to lower your household expenses in 7 easy steps: How to lower your household expenses in 7 easy steps? Are you tired of putting all your income into bills and expenses? You are not alone We show you some of the best ways to reduce your household costs. Read more to help you see where your biggest expenses lie. This gives you the opportunity to see if you can downsize the cards that are taking a big bite out of your income every time you get paid. It also shows you where you could save more, as each of your savings goals has a clear balance to show progress with.

Have you ever used Trello or a similar tool to manage your budget? Share your experiences and your own pros and cons regarding using Trello for budgeting in the comments below.