You are pregnant? Congratulations! From now on there are some important points to consider. From the mother-child passport and maternity protection to deciding on the right maternity leave model and financial issues. You can find all important information about pregnancy here.

Mother-child pass

As soon as you suspect a pregnancy, you should see your gynecologist as soon as possible. If it is indeed confirmed that you are pregnant, you will be issued a mother-child passport. All important dates and appointments for medical examinations during pregnancy and the first four years of the child's life are recorded on it. The first examination must be completed by the end of the 16. week of pregnancy take place.

Development of the baby

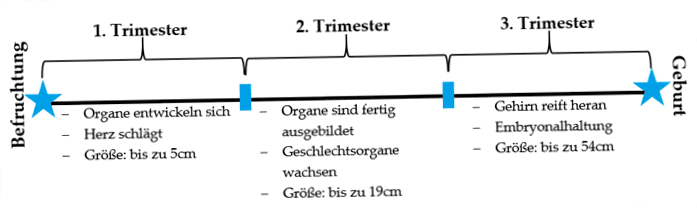

For the baby to develop properly, it spends nine months in the mother's womb . As the first trimester or. The first 12 weeks of pregnancy are referred to as the third trimester. During these weeks, the first accumulations of cells develop into organs. The little heart already starts beating at 120 to 160 beats per minute, while the baby can be up to five centimeters tall.

In the second trimester, the vital organs are already fully formed and the baby grows to ca. 19 centimeters. In addition, the sexual organs continue to develop and the baby begins to move and kick.

In the course of the third trimester, the brain matures. As a result, the bones of the skull become harder so that nothing can happen to the brain.

The baby looks for the most comfortable position, which is usually the usual embryonic position, since it does not have as much room in the mother's belly. Just before delivery, the baby is usually between 48cm and 54cm tall and weighs between 2800g and 4000g.

Maternity leave

As soon as the expectant mother has informed the employer that she is expecting a child, the legal provisions for maternity leave apply. You can find more information here.

Release of the father at birth

Those who are expecting offspring know that this involves a lot of dealings with the authorities. It is therefore easier if the father can take leave from work. But how does it behave with the time off for the father?

Special leave for the father on the occasion of the birth

In most collective agreements, it is common for the father to be granted time off with continued payment due to the birth of his child. There is no uniform regulation depending on the respective collective agreement.

According to §8 para. 3 AngG, an employee can take a leave of absence with continued payment due to childbirth. In order for the exemption to be justified, it can be stated, for example, that the spouse or cohabitant will be accompanied to the hospital for childbirth. If the collective agreement stipulated the period of time off, it only means that this is a minimum amount of days off. If a longer exemption is needed, it must be granted.

However, even if a child is already living in the same household, it is possible for the father to apply for a leave of absence from care if the mother has to go to hospital to give birth. So he can take care of the already existing child. You are entitled to up to the maximum of your regular weekly working hours. This means that if the mother works 40 hours a week, she is entitled to 40 hours of childcare leave per working year.

Entitlement to leave for the father after childbirth

During the time that the mother and the newborn child are in the hospital, there is no entitlement to caregiver leave. Only if an existing child lives in the same household can a childcare leave be requested.

If the mother is at home with the newborn and is unable to care for the baby on her own, the father of the child can apply for childcare leave. However, this is only possible if there is a common household and if there is a medical certificate that the mother cannot take care of the newborn alone. Again, the entitlement is up to the maximum of the regular weekly working hours.

If the child was born by cesarean section and the mother is still in need of care after the birth, the father can also apply for a leave of absence. This also only applies if there is a joint household.

Nursing leave after maternity leave and maternity leave

Even after maternity leave and maternity protection, both father and mother are entitled to care leave. Both must live in the same household with the child and be employed. If a child becomes ill, a care leave can be applied for if the child has not yet reached the age of ten and must be admitted as an inpatient. Here again the regular weekly working hours are taken as a basis.

Of course, children don't just get sick once. Additional caregiver leave may be granted if the child has not yet reached the age of twelve and becomes ill again. Caregiver leave can also be requested if the parent does not live with the child in the same household, so that the child is well cared for.

Parental leave

The maternity leave directly follows the maternity leave, moreover, the father can also claim it. If you would like to know more, you can continue reading here.

Costs and credits for pregnancy

It pays to be financially stable during pregnancy. On the one hand the income is reduced by the pregnancy and at the same time costs arise, which can well justify the need for financing.

Potential costs during pregnancy

Of course, it is up to the parents' discretion which offers are used. This list and the corresponding totals show what costs you will face during this stage of your life:

| Costs | Favorable | Average | High value / Expensive |

| Birth preparation course | 100 Euro | 120 euros | 150 Euro |

| Pregnancy gymnastics | 7 Euro/h | 10 Euro/h | 15 euros/h |

| Extra ultrasound | 50 Euro | 100 Euro | 200 Euro |

| Private hospital | 2.000 euros | 3.000 Euro | 4.500 euros |

Of course, health insurance pays for the most important benefits of pregnancy. But if it should be more than three ultrasound examinations, must be paid also itself. So a pregnancy can quickly 2.500 euros and more costs and thus the nursery is not yet furnished.

Tax benefits for families

Children cost money. The family allowance is often only a drop in the bucket and is usually not enough. But families can benefit from various tax advantages. The deductions that reduce income tax are just as important as the child allowance or the care and education costs that families can claim.

Families with handicapped children can also partially deduct the costs from taxes. We would like to show you which tax advantages a family has here.

The deduction for single parents

The deduction for single parents (AEAB) is available if the person concerned has received family allowance for more than six months in a calendar year. It does not matter whether the family allowance was received for one or more children. However, single parents only receive the deduction if they have not lived in a marriage, registered partnership or cohabitation for more than half of the calendar year.

The amount of the deduction for single parents is regulated as follows:

The AEAB wage tax is reduced once a year by the following amounts if family allowance is received for children.

- 494 Euro for one child

- 669 euros for two children

- for the third and each additional child by an additional 220 euros

The sole earner deduction

Single earners also benefit from the tax advantages, but they have to meet a number of requirements in order to do so.

The sole-earner deduction (AVAB) is available to anyone living in a marriage, registered partnership or cohabitation that lasts longer than six months in a calendar year.

In addition, family allowance must have been received for children for at least six months. Your partner is not allowed to earn more than 6.have earned EUR 000. If you are below the additional earnings limit, you can calculate the additional earnings limit using this help:

Gross annual earnings including all special payments, such as vacation or Christmas bonuses

- minus tax-free supplements and allowances

- minus tax-exempt special payments up to a maximum amount of 2.100 euros

- minus union dues

- minus social security contributions

- minus the flat rate for commuters

- minus severance pay and weekly allowance

- minus the minimum income-related expenses allowance of 132 euros

RESULT: Additional earnings limit for the sole-earner deduction

But be careful: Only the weekly allowance may be included in the calculation. Family allowance, childcare allowance, unemployment assistance, unemployment benefits as well as maintenance payments and training and promotion allowances from the AMS do not play a role in the calculation of the additional earnings limit.

In the case of the sole-earner deduction, the wage tax is also reduced once a year if family allowance is received for children. 494 Euro for one child, 669 Euro for two children and 220 Euro for each additional child.

How to claim AEAB and AVAB

You can claim the deduction for single parents as well as that for single earners either via the company as well as via the employee tax return. However, it is important to make sure that the check marks are set correctly. For even if you make the application through the company, a tick must be made in the field for employee assessment. This is how the tax office knows that you are entitled to this deduction in the calendar year.

In this case, AEAB or AVAB is only refunded via the employee tax assessment, and as a negative tax, if

- the income is less than 1.was 190 euros/month and thus did not have to pay income tax

- no tax-exempt benefits, such as unemployment benefit or childcare allowance, were received in the entire calendar year

The multiple child supplement

A family can also claim this if certain conditions are met. The multiple child supplement of 20 euros for the third and each additional child may be received if the parents:

- not more than 55.earn 000 euros per year together

- had a joint household for more than six months in the calendar year

- for the children receiving family allowance

This multi-child supplement is obtained via the employee tax assessment.

The alimony deduction

Maintenance paid to children who do not live in the same household can also be deducted from taxes. However, this maintenance deduction must be proven and it must have been paid in full. Furthermore, this is only possible if the children live in Austria, the EU, Switzerland, Liechtenstein, Norway or Iceland.

The following maintenance deductions apply:

- 29.20 euros per month for the first child

- 43,80 Euro per month for the second child

- 58.40 euros per month for each additional child

In addition, the following standard needs rates apply for 2020:

- 212 euros per month for children up to 3 years

- 272 Euro per month for children up to 6 years of age

- 350 euros per month for children up to 10 years

- 399 Euro per month for children up to 15 years of age

- 471 euros per month for children up to 19 years of age

- 590 euros per month for children up to the age of 28

Family bonus plus

Since 2019, the Family Bonus Plus has replaced the child allowance and is available for every child up to the age of 18. birthday to. The maximum amount per child here is 1.500 euros. For low-income earners, who hardly benefit from the Family Bonus Plus, there is the additional child amount of 250 euros per child per year.

Important: The Family Bonus Plus must be applied for with the employer using form E30 and will be taken into account by the employer in the monthly salary.

The childcare costs

Childcare costs can also be claimed from the tax office. However, it is immaterial whether the childcare costs are shared by both parents. Even meals are included and paid up to an amount of 2.300 Euros per child per calendar year can be deducted, subject to the following conditions:

- The child must have been entitled to family assistance for more than six months in the calendar year, or the child was entitled to a maintenance allowance for more than six months.

- The child has reached the age of 10. The child has not yet reached the age of 65 at the beginning of the assessment year, or there is a disability and the family receives the increased family allowance. Then the child may celebrate the 16. The child must not have reached the age of 6 at the beginning of the assessment year.

- If the child is cared for by a qualified pedagogical person, i.e. a childminder, or if the child is in a care facility in accordance with the provisions of state law.

Childcare costs are tax deductible

Children cost a lot of money and fortunately childcare costs can be deducted in Austria. But how high is the maximum amount and what to look out for? We would like to explain this briefly and informatively here.

The deduction for child care can be up to 2 % per year and child.300 euros.

For which child can childcare costs now be deducted? This can be deducted for children who have not yet reached the age of ten at the beginning of the calendar year. However, the child must have been entitled to the child deduction for six months in the calendar year.

The childcare costs can be deducted by the person who was entitled to the child deduction for more than six months of the year. Of course, the partner can also deduct the childcare costs.

It is also possible for the parent who is liable to pay maintenance, i.e. the divorced parent, to deduct the costs if he or she was entitled to a maintenance deduction for more than six months. However, only if the childcare costs were paid in addition to the child's upkeep.

Each of these persons can deduct the childcare costs for tax purposes. However, as an extraordinary burden per calendar year, only 2.300 euros per child can be deducted. If the amount is exceeded by the taxpayers, the maximum amount is divided in proportion.

For children who are entitled to an increased family allowance, extraordinary expenses can also be claimed. A flat-rate allowance of 262 euros per month applies.

Furthermore, costs that are substantiated can be tax deductible. This includes, for example, tuition at a special or nursing school or work in a workshop for the disabled. In addition, it is also possible to deduct care costs that are not related to the o. g. costs are related to the child. If the child is cared for due to the need for care, the costs are to be reduced by the care allowance received.

As a rule, childcare costs of 2.300 euros per calendar year and child are deductible. Unless there is a special case (single parent). Then these can also be deducted, however, the amount is reduced by the income-related deductible.

Only childcare costs that were actually paid can be deducted. If the employer pays part of the childcare costs, only the costs paid by the taxpayer can be claimed. In addition, the care must be provided by a pedagogically qualified person, such as in a kindergarten, after-school care center or half- and full boarding school.

Not only the childcare costs, but also the costs for handicraft money as well as meals are to be listed. Costs for a private school, tutoring or even the costs for childcare and the placement of a caregiver cannot be deducted.

Furthermore, costs for afternoon or vacation care as well as the costs of a vacation camp can be taken into account. However, this is only possible if the care is provided by a pedagogically qualified person. Nevertheless, the expenses for school and afternoon care must be clearly separated.

Persons who are pedagogically qualified must provide evidence of training in child education and care of at least eight hours. In addition, these persons must have reached the age of 16. have reached the age of 16. In addition, a certificate must be submitted for the caregiver from the age of 16. childcare costs from the age of 21 until the age of 21. The child must be able to prove that he or she has received training before the age of 60. The minimum of 16 hours is decisive here.

Of course, there is also the possibility to prove a completed professional training.

- Training as a kindergarten teacher, early childhood educator or after-school educator

- Pedagogic university study, for example teacher training

- Pedagogical partial studies, for example business pedagogy

- Course for childminders according to the legal regulations

- Training as an au pair

- Training seminar or parent education seminar, for example, babysitter training course

The above-mentioned items can only be recognized if they comply with the legal requirements.

If the child is cared for by relatives (parents or siblings), the care amount cannot be claimed for tax purposes, even if the caregiver is pedagogically qualified.

In order to be able to deduct childcare costs, proof must be provided of the following.

In this case, an invoice or. a payment voucher is issued, which must contain these items:

- Recipient of the invoice with name and address as well as date of issue

- Consecutive invoice number and period of childcare

- Name and social security number of the European Health Insurance Card of the child in care

- Name, address, social security number of the European Health Insurance Card as well as the specific qualification (copy) of the caregiver

- Name and address of the public institution or. a reference to the allowance for facility management in the case of private care

- Invoice amount including sales tax. In the case of a small business without sales tax.

All receipts must be kept for seven years and presented upon request by the tax office.

Single parents and childcare costs

Single parents can also deduct childcare costs. In this case, the amount is not higher, as in the case of families, and amounts to 2 including boarding costs.300 euros.

However, higher childcare expenses can be deducted via extraordinary expenses with deductibles. These costs can be deducted, as for families up to the age of 10. The costs of childcare can be claimed as an extraordinary burden without a deductible until the age of 21.

However, even after the 11. From the age of 21 until the end of compulsory schooling, childcare costs can be deducted as an extraordinary burden with a deductible.

Vocational training away from home for children

If there is no corresponding school, university or apprenticeship in the place of residence, these costs can also be claimed. An allowance of 110 euros per month is available for each month started.

If the child is at school for the entire calendar year or is undergoing training at another location, even the vacation time can be written off. However, there are some requirements here to claim these costs:

- The place of education must be more than 80km away from the place of residence

- If the place of education is less than 80km away, it must be proven that the outward and return journey is unreasonable according to the Study Support Act. It is not reasonable if the fastest route by public transport takes longer than one hour.

- These costs can also be deducted for apprentices or students who are accommodated in secondary accommodation at the place of training. However, there must not be a corresponding training opportunity within a radius of 25 km, which must also be proven.

Medical expenses for children with disabilities

Medical expenses for children with disabilities can also be deducted. This is done via the employee tax assessment and depends on the degree of disability of the child.

Actual expenses incurred due to disability can be considered minus long-term care benefits if you have a disability up to 24 percent. However, these costs only have a tax effect if they actually exceed the deductible amount.

Without a deductible, medical expenses are listed under "extraordinary expenses" if the disability is 25 to 49 percent.

From a degree of disability of 50 percent, there is on the one hand an increased entitlement to family allowance and on the other hand the actual expenses or an allowance of 262 euros per month can be claimed. Furthermore, costs for special or nursing schools, workshops for the disabled, aids as well as curative treatments can be deducted from taxes.

If you pay attention to these tax benefits, you can save a lot of money – even if it's only at the end of the year and you therefore have to make an advance payment.